Kick the 10 Bad Habits of the Chronically Indebted

By Natalie Pace.

Is your home underwater? Do you owe more on your credit cards than you earn each month? Is your tax bill more than 1/3 of your income? Do you have every insurance policy that the salesman offers? Have you been telling yourself that you'll save/invest money someday after you pay off debt? Do you deny yourself even small treats to try and balance your unsustainable budget, which is often supplemented from a credit card or by siphoning off home equity?

Did you know that all of these are signs of being chronically indebted?

10 Habits of the Chronically Indebted

1. You'll start saving once you pay off debt.

If your first consideration is always paying down debt, before protecting your money and compounding your gains, then you have placed the debt collector as the first priority in your life. If you think this adds up, then you are not factoring in the power of compounding gains, paying less in taxes and adopting a more sustainable budget. None of the people you owe money to are going to take up a collection to help you if you lose your job or get sick. Providing for your own future is always your first priority.

2. You Think of Wall Street as a Casino.

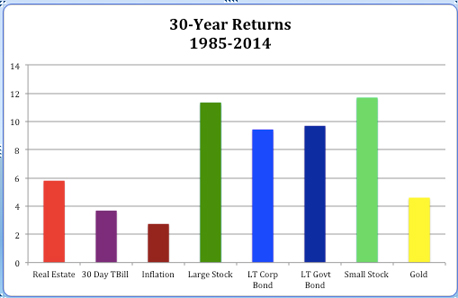

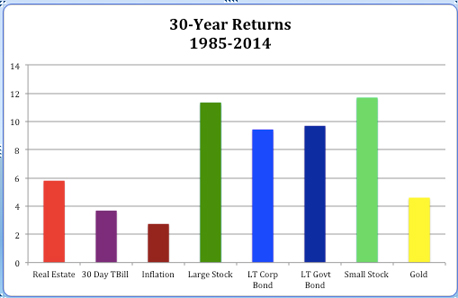

If you think that gold is safer than stocks, then you need to think again. Over a 30-year period, gold is one of the worst investments. Those who invested in gold at the high in 1980 had to wait a quarter of a century for the value of their investment to come back to even. In fact, over the long-term, investing in great companies that make the products we love offers the best return. Replace fear with facts.

Sources: Morningstar & National Association of Realtors. Chart compiled by NataliePace.com.

3. You buy high and sell low.

When an investment loses value, if your first thought is to sell it, then your stomach acid, not your wisdom, is in charge. The same is true if when a sector is hot, you want to join the party at any cost. The aphorism is buy low; sell high, which is easy to say and difficult to do.

4. You blame others for losing your money.

Rather than taking ownership and responsibility for what you invest in and for your budget, you blame others for convincing you to invest in something and losing your money. If you buy something you can't really afford, it's the salesman's fault for convincing you to purchase it. In fact, if you're truly honest with yourself, part of the reason that you give your power to others is so that you can blame them if things go wrong. You are the boss of your money and your life, and it's time to get smart and take charge.

5. You Hide Your Problems.

Far too many people hide their problems until it is too late to get help. Why? Because it is embarrassing to admit that we are failing at life math. Financial literacy isn't taught at school; even MBA CEOs can fail the real world test. Royals and billionaires learn tax, budgeting, investing and husbandry strategies at home, and so should you.

6. Everything Will Be Great When I Get a Raise.

Most people think that more money is the solution to all of their problems. In truth, what's really needed is a better budget and creative thinking on how to pay less on taxes, utilities, housing, food, transportation and the other big expenses of living. If Mitt Romney can pay only 14% in taxes, so can you. If electrical engineers can pay 10% of what you spend on electricity, so can you. If riding a bike could put an extra $3000 in your wallet each year in gasoline savings, you should consider it. If Asian Americans could be almost enslaved in America a century ago and become the top income earners today, so can you.

http://www.dol.gov/_sec/media/reports/asianlaborforce/

7. Launching a Business on a Credit Card.

Sadly, there is an entrepreneurial myth out there that it's okay to launch a business on your credit card. This easy money is, by far, the most expensive source of capital you can tap. Entrepreneurs who use credit cards to launch or expand their business end up paying usury rates �" often for years after the business goes belly-up! It's not smart to tap your credit card as a loan.

8. You Use Your Home as an ATM Machine.

This is less likely to happen in today's world than before the real estate bust in 2006. However, even today, homeowners who are able to are tempted to make ends meet by pulling equity out of their home. In most cases, this is a terrible idea. There are other options, such as downsizing and potentially renting out your home for additional income, that could actually increase your net worth and afford you a much richer life.

9. Emotions Are Jerked Around By Headlines.

Is the news on 24/7 in your home? Do you yell at the TV, at politicians and feel at the mercy of a world that is outside your control? Does your mood start to sour at the end of each month when you run out of money, or whenever the stock market falls?

10. You Try to Keep Up With the Joneses.

Sadly, what shopaholics (and alcoholics) never realize is that it is no fun to be enslaved by a vice. It's not even a lot of fun in the moment. And it certainly crashes the next day when you realize that you're going to be paying for your spree for years to come...

If you're in debt, it's time to get a new plan.

The Gratitude Game: 21 Days to a Healthier, Wealthier, More Beautiful You offers a step-by-step program to make prosperity and abundance your daily habit by teaching you how to embody and employ the same strategies used by billionaires and royals. If you're ready to swap out debt consciousness for wealth consciousness, this is a great New Year; New You gift to get for yourself.

Call our offices at 310-430-2397 to learn more.

About Natalie Pace:

Natalie Pace is the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and You Vs. Wall Street (aka Put Your Money Where Your Heart Is in hard cover). Natalie has been saving homes and nest eggs for 14 years, while at the same time earning the ranking of No. 1 stock picker. Natalie Pace is a blogger on HuffingtonPost.com and a repeat guest on national television and radio shows such as Good Morning America, Fox News, CNBC, ABC-TV, Forbes.com, NPR and more. As a strong believer in giving back, she has been instrumental in raising tens of millions for public schools, financial literacy, the arts and underserved women and girls worldwide. Follow her on Twitter.com/NataliePace, Plus.Google.com/+NataliePace and Facebook.com/NatalieWynnePace. For more information please visit NataliePace.com. Click to access a longer bio on Natalie Pace.

Opinions expressed by the author are not necessarily those of WITI.

Are you interested in boosting your career, personal development, networking, and giving back? If so, WITI is the place for you! Become a WITI Member and receive exclusive access to attend our WITI members-only events, webinars, online coaching circles, find mentorship opportunities (become a mentor; find a mentor), and more!

Founded in 1989, WITI (Women in Technology International) is committed to empowering innovators, inspiring future generations and building inclusive cultures, worldwide. WITI is redefining the way women and men collaborate to drive innovation and business growth and is helping corporate partners create and foster gender inclusive cultures. A leading authority of women in technology and business, WITI has been advocating and recognizing women's contributions in the industry for more than 30 years.

The organization delivers leading edge programs and platforms for individuals and companies -- designed to empower professionals, boost competitiveness and cultivate partnerships, globally. WITI’s ecosystem includes more than a million professionals, 60 networks and 300 partners, worldwide.

WITI's Mission

Empower Innovators.

Inspire Future Generations.

Build Inclusive Cultures.

As Part of That Mission WITI Is Committed to

Building Your Network.

Building Your Brand.

Advancing Your Career.

Comments