There is no denying that women are earning and controlling more wealth than ever before and have become powerful influencers of household investment and financial decisions. However, according to a recent New York Life Investments survey, over 40% of women investors lack confidence in their knowledge of the market and 29% lack confidence in their ability to make decisions between investment options.

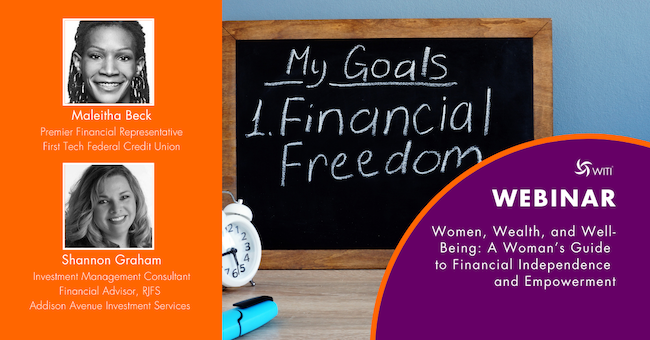

Our presenters will share introductory concepts to help women become more empowered with their finances. They'll also share how to take these concepts and apply them to set and define your financial goals for you and your family. Join us as we discuss:

- Women in the world today

- Building a financial foundation

- Creating an independent retirement path

Presenters: Maleitha Beck

Maleitha Beck

Premier Financial Representative

First Tech Federal Credit Union

With over a decade in the Financial Services industry, Maleitha Beck is passionate about giving back to her community by utilizing her financial education and awareness expertise. "There is no better feeling than helping someone understand their finances and empowering them to shape their financial future."

Maleitha has more than 12 years of progressive experience in the financial services industry and five years of leadership in Human Resources, with particular focus on and passion for Diversity, Equity and Inclusion. She also volunteers with Big Brothers Big Sisters of the Bay Area, as well as Forgotten Felines of Sonoma County.

Shannon Graham

Shannon Graham

Investment Management Consultant

Financial Advisor, RJFS

Addison Avenue Investment Services

When it comes to investing, Shannon Graham integrates a personal approach to helping women meet their financial goals. She first works with the client to develop a strategy only after evaluating individual needs, timeframe, and tolerance for risk. Once a plan is established, Shannon continues to evaluate the client's financial strategy over time, making any necessary adjustments around cash flow management, tax-advantaged strategies, and more, to ensure that it continues to meet the client's needs.

Shannon feels that one of the most rewarding parts of her job is assisting people in their time of need. From helping families save for their child's college education, to advising women how to invest on their own, to supporting widows and widowers during stressful times, Shannon's goal is to filter out the noise and focus on the dreams, goals, and priorities that will allow every client to feel confident about their decisions.

Financial Advisors offer securities through Raymond James Financial Services, Inc. Member FINRA/SIPC and securities are not insured by credit union insurance, the NCUA or any other government agency, are not deposits or obligations of the credit union, are not guaranteed by the credit union, and are subject to risks, including the possible loss of principal. First Tech Federal Credit Union and Addison Avenue Investment Services are not registered broker/dealers and are independent of Raymond James Financial Services, Inc. Investment advisory services offered through Raymond James Financial Services Advisors, Inc.

This event was held online. The recording is available for WITI Members.